Importer of Record vs. Consignee: Who’s Responsible for Compliance?

Importer of Record (IOR)

During your import process, you will face two key players in the industry: the importer of record and the consignee. You will always be confused about whether to use an IOR or a consignee, but don’t worry; we are here to clear your mind of all of these complexities. We will discuss in detail who the consignee is, their responsibilities, the difference between them, and who is more suitable for your business.

An importer of record is an entity or individual responsible for importing goods to another country and overseeing all compliance and regulations related to the destination country’s commodities, including documentation, taxes, and all customs clearance.

A consignee is the designated person or organization to whom goods are shipped and delivered. They are responsible for receiving the merchandise at the destination specified in the transportation documents, such as the Bill of Lading (BOL), and assuming ownership once the goods clear customs. Also known as the “receiver,” and is often responsible for paying for the goods and any associated shipping fees, customs duties, and taxes based on the terms agreed upon with the consignor (sender).

Their role is essential for ensuring the smooth transfer of ownership and compliance with all legal and financial obligations related to the shipment.

What are the Responsibilities of an Importer of Record?

Several key tasks the importer of record is required to do in any import process:

Firstly, overseeing all essential documents and certificated information about the imported goods or the destination country.

Then, ensures imported goods comply with all laws and regulations of the imported country, including safety regulations and packaging requirements

Additionally, an IOR is responsible for paying all taxes and duties associated with imported goods.

What are the Responsibilities of a Consignee?

The consignee plays a critical role in the shipping and logistics process. As the party to whom goods are shipped, their responsibilities include ensuring the smooth transfer, receipt, and handling of the goods

Here are the primary responsibilities of a consignee:

Receiving Goods

Receiving the goods as specified in shipping documents.

Inspection

Upon receipt, he inspects the goods to ensure they match the descriptions and are in good condition.

Notification of Arrival

Notified in advance of the goods’ arrival, allowing them to prepare for reception and unloading.

Providing Access

He must provide access to the delivery location and facilitate unloading, coordinating with carriers or logistics providers.

Document Verification

Responsible for ensuring all accompanying documentation (e.g., bill of lading) is accurate and matches the received goods.

Storage and Handling

Managing proper storage and handling of the goods, ensuring they are stored under appropriate conditions.

Communication with Shippers

Maintains active communication with shippers, carriers, or logistics providers to address any issues or discrepancies during delivery.

Notifying Issues

If discrepancies or issues arise with the delivered goods, he must promptly notify the shipper or relevant parties

Customs Clearance (if applicable)

In some cases, he may be responsible for clearing goods through customs, which includes completing documentation and paying applicable fees.

Financial Accountability

He may handle various charges such as customs duties and freight fees, ensuring accurate record-keeping of these transactions.

Is the consignee the same as the importer of record?

The consignee is not the same as an importer of record; they usually differ in the timing of taking over. The IOR takes over during the import process, while the consignee takes over after landing at the port. It’s the last step in the import process. The following parts will discuss the main differences between the importer of record and consignee in detail keep reading on:

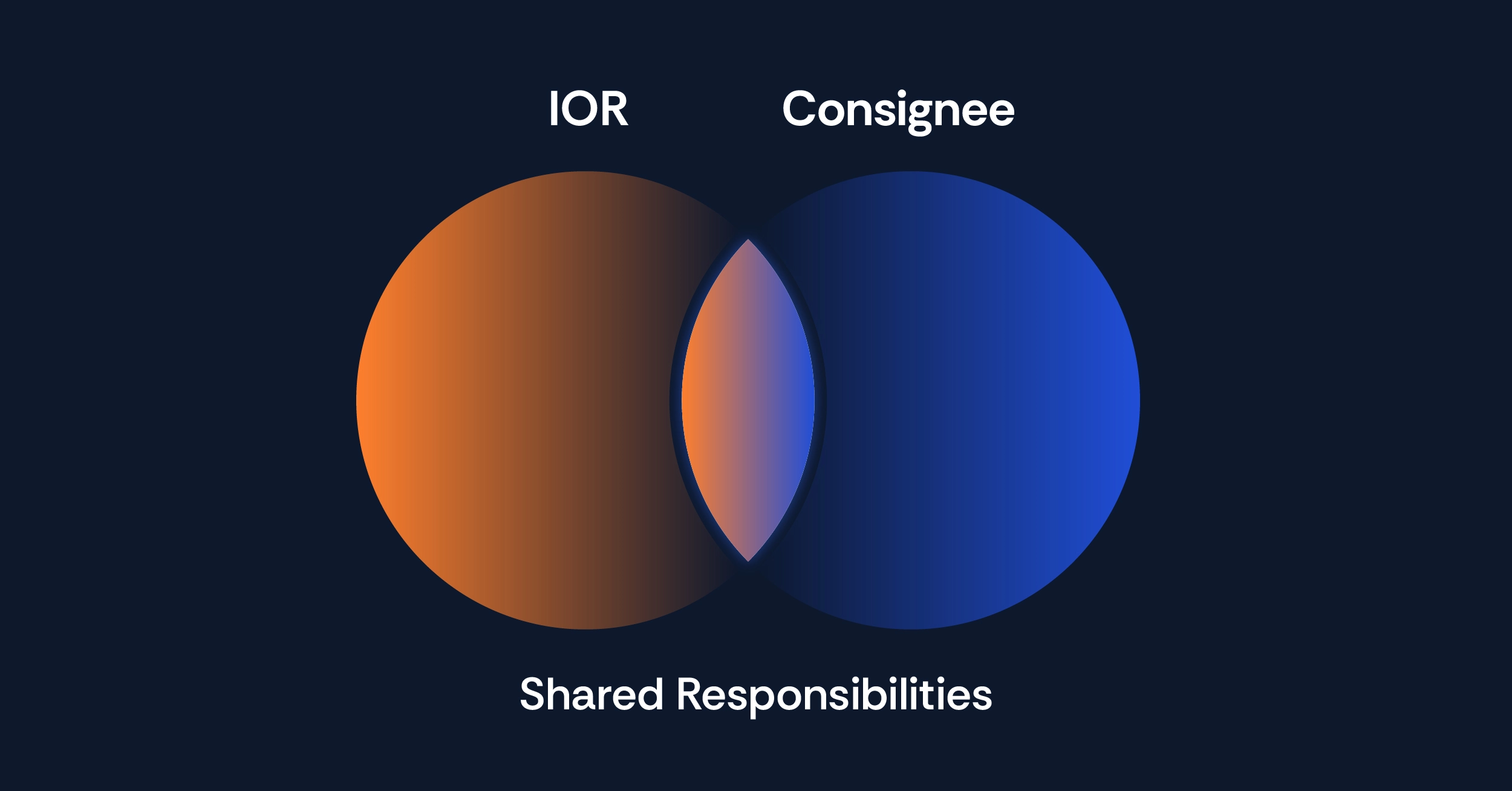

Shared Roles and Responsibilities of IOR and Consignee

The roles of consignee and importer of record have a clear difference; however, they may share some essential roles in certain areas, such as:

Receiving and inspecting goods.

Ensuring effective communication with shippers and logistics providers.

Verifying that goods match shipping documents.

Addressing issues and resolving discrepancies in shipments.

Differing Responsibilities of IOR and Consignee

The importer of record and consignee are different, as the IOR assumes liability for the importation process. In contrast, the consignee’s responsibilities start after the goods have cleared customs. The following table compares the roles of importer of record vs consignee, highlighting their key differences and responsibilities:

Aspect | Importer of Record (IOR) | Consignee |

|---|---|---|

Definition | The legal entity responsible for ensuring imported goods meet all regulatory and legal requirements. | The person or organization designated to receive the goods after they have cleared customs. |

Legal Responsibility | Holds legal responsibility for the shipment, ensuring compliance with import regulations and payment of duties. | Assumes ownership of goods upon receipt but does not directly handle legal compliance or importation responsibilities. |

Customs Interaction | Serves as the primary liaison with customs authorities, handling all paperwork and ensuring compliance. | Typically does not interact with customs authorities and focuses on receiving and managing the goods. |

Payment of Duties | Calculates and pays applicable duties and taxes before the goods are cleared through customs. | May be responsible for paying import duties and taxes, typically after customs clearance. |

Knowledge of Regulations | Must have in-depth knowledge of customs laws and regulations to ensure full compliance. | Does not need to be well-versed in customs laws; primarily focuses on logistics and distribution. |

Ownership | Temporarily owns the goods until customs clearance is complete, but may not physically possess them. | Takes full ownership of the goods once they have cleared customs and are received. |

Role in Logistics | Ensures the import process runs smoothly, particularly for entities without a presence in the importing country. | Handles the storage, distribution, and further management of goods after receipt. |

How to know if you need an Importer of Record or a Consignee?

So, how should you decide between a consignee and an IOR? Well, it depends on some circumstances as follows:

The following provides a detailed explanation of when an IOR is needed:

First-Time Imports: If you are importing goods into a new country, it’s wise to appoint an IOR. Their expertise in local customs regulations ensures compliance and smooth entry of goods.

Complex Shipments: For shipments involving multiple parties (e.g., suppliers and distributors), an IOR helps clarify ownership and ensures the import process is streamlined.

Lack of Local Presence: If your business doesn’t have a physical presence in the destination country, an IOR can handle customs paperwork and legal compliance on your behalf.

Regulatory Knowledge: If you’re unfamiliar with the destination country’s customs laws, an IOR will ensure all paperwork is accurately completed and filed, minimizing the risks of delays or fines.

The following provides a detailed explanation of when a consignee is needed:

Familiarity with Customs Procedures: If you have experience with customs clearance in the destination country and are comfortable managing the paperwork, acting as the consignee may be sufficient.

Direct Ownership: If you’re importing goods for personal use or distribution and can handle duties and taxes on receipt, you may not need an IOR.

Simpler Transactions: For straightforward shipments where regulatory compliance isn’t complex, a consignee can handle the receipt and condition check of the goods.

Delegating Responsibilities: If you prefer to focus on logistics without handling customs compliance, appoint a customs broker to manage customs duties while you act as the consignee.

Import your Tech and IT Products with IOR Africa!

The consignee receives goods, but the Importer of Record Service ensures compliance with local laws, tariffs, and import permits. We will handle all the legal complexities and make sure your imports go smoothly.