A commercial invoice is a crucial document in international trade that provides a detailed record of a transaction between a buyer and a seller. It serves as a proof of sale, a customs declaration, and an essential financial document for businesses engaged in cross-border trade. Understanding the intricacies of commercial invoices is vital for smooth and efficient international transactions.

Purpose and importance of commercial invoices

The purpose is to provide a comprehensive breakdown of the goods being shipped, including their value, quantity, and description. This document is essential for customs officials to assess the applicable duties, taxes, and tariffs on imported or exported goods. Moreover, it serves as a legal record of the transaction between the buyer and seller, ensuring transparency and accountability.

It plays a pivotal role in international trade by facilitating proper customs clearance, ensuring accurate valuation of goods, and minimizing the risk of disputes. They provide a clear and verifiable account of the transaction, protecting the interests of both parties involved. Without a properly filled invoice, shipments may face delays, incur additional costs, or even be refused entry by customs authorities.

Information required on a commercial invoice for shipping

It contains various essential pieces of information that are necessary for smooth shipping and customs clearance.

These include:

1. Seller and buyer details: Clearly state the complete name, address, and contact information of both the seller and buyer. This enables easy identification and communication between the parties involved.

2. Invoice number and date: Each invoice should have a unique identification number and the date on which it was issued. This helps in tracking and referencing the document throughout the transaction and ensures accurate record-keeping.

3. Description of goods: A detailed and accurate description of the goods being shipped is vital. This includes information such as the quantity, weight, dimensions, and any relevant product codes or classifications. The description should be clear and concise, enabling customs officials to identify the goods easily.

4. Unit price and total value: Clearly state the unit price of each item and the total value of the goods being shipped. This information is crucial for customs officials to accurately assess the applicable duties and taxes.

5. Payment terms and currency: The invoice should specify the agreed-upon payment terms between the buyer and seller, such as the method of payment and the currency in which the transaction is conducted. This ensures clarity and avoids any confusion regarding the financial aspects of the transaction.

6. Shipping details: This should include information about the mode of transportation, the carrier, the expected delivery date, and any relevant shipping references or tracking numbers. These details help in tracking the shipment and ensuring its timely delivery.

By providing accurate and comprehensive information, businesses can streamline the shipping process, prevent unnecessary delays, and ensure a smooth customs clearance.

Understanding the international commercial invoice

When engaging in international trade, it is essential to understand the specific requirements and regulations associated with an international commercial invoice. While the basic elements of an invoice remain the same, additional information or documentation may be required for customs purposes.

International invoices often require additional details such as the country of origin of the goods, the terms of sale (Incoterms), and any applicable export or import licenses. It is crucial to research and understand the specific requirements of the destination country to ensure compliance with their customs regulations.

Moreover, international invoices may need to be prepared in multiple languages to facilitate customs clearance in different countries. This ensures that customs officials can easily understand the contents of the invoice and accurately assess the applicable duties and taxes.

To navigate the complexities of international trade successfully, it is advisable to seek the assistance of customs brokers or trade experts who can guide the specific requirements for international invoices.

How to create a commercial invoice

Creating an invoice involves a systematic process to ensure accuracy and compliance with relevant regulations.

Here are the steps to create an invoice:

- Gather necessary information: Collect all the required information for the invoice, including seller and buyer details, description of goods, unit price, total value, payment terms, shipping details, and any additional customs requirements.

- Choose a template or software: Utilize an invoice template or specialized software to create the invoice. These tools provide a structured format and ensure that all necessary information is included.

- Enter seller and buyer details: Fill in the complete name, address, and contact information of both the seller and buyer. Double-check the accuracy of this information to avoid any communication or delivery issues.

- Provide a detailed description of goods: Include a clear and concise description of the goods being shipped, specifying the quantity, weight, dimensions, and any relevant product codes or classifications. Use industry-standard terminology to ensure clarity.

- Enter the unit price and total value: State the unit price of each item and calculate the total value of the goods. This should accurately reflect the agreed-upon price between the buyer and seller.

- Specify payment terms and currency: Clearly state the payment terms, such as the method and timeline of payment, and the currency in which the transaction is conducted. This avoids any confusion or disputes regarding the financial aspects of the transaction.

- Include shipping details: Provide information about the mode of transportation, carrier, expected delivery date, and any relevant shipping references or tracking numbers. This enables tracking and ensures timely delivery.

- Review and confirm: Double-check all the information on the invoice for accuracy and completeness. Ensure that it complies with the specific requirements of the destination country, if applicable.

- Save and distribute: Save a copy of the completed invoice for record-keeping purposes. Distribute copies to the buyer, seller, and any other relevant parties involved in the transaction.

By following these steps, businesses can create accurate and compliant invoices that facilitate smooth transactions and customs clearance.

How to fill out a commercial invoice accurately

Properly filling out an invoice is crucial to ensure accurate customs assessment, smooth shipping, and legal compliance.

Here are some key guidelines to follow when filling out an invoice:

- Provide complete and accurate information: Fill in all the required fields of the invoice with complete and accurate information. This includes seller and buyer details, description of goods, unit price, total value, payment terms, and shipping details.

- Use clear and concise language: Write the description of goods clearly and concisely, using industry-standard terminology. Avoid vague or generic descriptions that may lead to confusion or delays during customs clearance.

- Be specific about quantities and values: Clearly state the quantity of each item being shipped and the corresponding unit price. Calculate the total value accurately, including any applicable taxes or discounts.

- Ensure consistency with supporting documents: Cross-reference the information on the invoice with other supporting documents, such as the packing list or purchase order. Ensure that all documents align and provide a cohesive and accurate picture of the transaction.

- Include relevant customs information: If required, include any additional customs information or documentation, such as the country of origin of the goods, export or import licenses, or applicable Incoterms. Research the specific requirements of the destination country to ensure compliance.

- Review and double-check: Before finalizing the invoice, carefully review all the information for accuracy and completeness. Check for any typographical errors or missing details that may cause issues during customs clearance.

By diligently following these guidelines, businesses can ensure that their invoices are filled out accurately, minimizing the risk of delays or disputes during international trade.

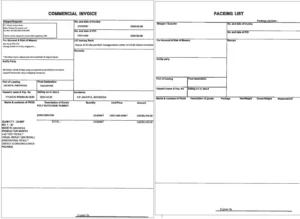

Difference between commercial invoice and packing list

While both a commercial invoice and a packing list are essential documents in international trade, they serve different purposes and contain different information.

Here are the key differences between a commercial invoice and a packing list:

- Content and purpose: An invoice provides a comprehensive breakdown of the goods being shipped, including their value, quantity, and description. It serves as a proof of sale, a customs declaration, and a financial document. On the other hand, a packing list itemizes the physical contents of each package or container, specifying the number of items, their dimensions, and weight. Its purpose is to facilitate accurate shipment verification and inventory management.

- Legal significance: An invoice holds legal significance as it represents a contractual agreement between the buyer and seller. It is used for customs clearance and financial record-keeping. In contrast, a packing list has no legal significance and is primarily used for logistical purposes.

- The information included: An invoice includes details such as seller and buyer information, invoice number and date, description of goods, unit price and total value, payment terms, and shipping details. A packing list, on the other hand, includes details such as the number of packages or containers, their dimensions, weight, and a description of the contents.

- Use in customs clearance: Customs officials must assess the applicable duties, taxes, and tariffs on imported or exported goods. It provides the necessary information for accurate customs valuation and facilitates proper customs clearance. A packing list, while not directly used for customs valuation, assists in verifying the physical contents of the shipment during customs inspections.

Both a commercial invoice and a packing list are necessary for international trade, and businesses should ensure that both documents are accurately filled out and accompany the shipment.

Commercial invoice vs. proforma invoice: What’s the difference?

While an invoice and a proforma invoice are both used in international trade, they serve different purposes and are issued at different stages of the transaction.

Here are the key differences between an invoice and a proforma invoice:

- Timing and purpose: A proforma invoice is issued before the completion of a sale, providing a preliminary quotation or proposal to the buyer. It outlines the terms of the potential sale, including the description and estimated value of the goods, payment terms, and shipping details. On the other hand, an invoice is issued after the sale has been finalized and serves as proof of sale, a customs declaration, and a financial document.

- Legal significance: An invoice holds legal significance as it represents a contractual agreement between the buyer and seller. It is used for customs clearance and financial record-keeping. A proforma invoice, being a preliminary document, does not carry the same legal significance and is primarily used for informational and negotiation purposes.

- Payment expectation: A proforma invoice outlines the payment terms and expectations, allowing the buyer to review and confirm the terms of the potential sale. It is not a payment request. However, serves as a request for payment and includes the agreed-upon price and payment terms.

- Use in customs clearance: Customs officials must assess the applicable duties, taxes, and tariffs on imported or exported goods. It provides the necessary information for accurate customs valuation and facilitates proper customs clearance. A proforma invoice, being a preliminary document, is not used for customs valuation or clearance.It is essential to understand the distinction between an invoice and a proforma invoice to ensure accurate documentation and compliance with international trade regulations.

Commercial invoice for shipping: What you need to know

When shipping goods internationally, it is a vital document that must accompany the shipment.

Here are some key points to know about commercial invoices for shipping:

- Mandatory requirement: it is a mandatory document for international shipments. Customs authorities require it to assess the applicable duties, taxes, and tariffs on imported or exported goods. Failure to provide an invoice may result in shipment delays or refusal of entry.

- Accuracy and completeness: It is crucial to fill out the invoice accurately and completely, providing all the required information. Inaccurate or incomplete information may lead to delays, additional costs, or even legal issues.

- Customs regulations and requirements: Different countries have different customs regulations and requirements regarding invoices. Research and understand the specific requirements of the destination country to ensure compliance and a smooth process.

- Importance of supporting documentation: Invoices should align with other supporting documents, such as the packing list or purchase order. Consistency and accuracy between these documents are essential to avoid any discrepancies during customs inspections.

- Electronic transmission: invoices can be transmitted electronically, which can streamline the shipping process and reduce paperwork. However, it is crucial to ensure that electronic invoices comply with the specific regulations of the destination country. Proper knowledge and adherence to the requirements and regulations surrounding invoices for shipping are essential to ensure smooth international transactions and customs clearance.

Importance of proper documentation for customs clearance

Proper documentation is of utmost importance for smooth customs clearance and efficient international trade.

Here are the key reasons why proper documentation, including commercial invoices, is crucial:

- Customs compliance: Customs authorities require accurate and complete documentation to assess the applicable duties, taxes, and tariffs on imported or exported goods. Proper documentation ensures compliance with customs regulations and reduces the risk of delays or penalties.

- Transparency and accountability: Invoices and other supporting documents provide a clear and verifiable account of the transaction between the buyer and seller. They serve as evidence of the goods being shipped, the value of the transaction, and the terms of sale. This ensures transparency and accountability between the parties involved.

- Risk management: Accurate documentation helps manage the risks associated with international trade. It provides a clear record of the goods being shipped, their value, and the agreed-upon terms. In case of disputes or discrepancies, proper documentation can serve as evidence and help resolve the issues efficiently.

- Efficient customs clearance: Proper documentation enables customs officials to assess the applicable duties, taxes, and tariffs accurately. This leads to faster customs clearance, minimizing delays, and ensuring timely delivery of goods.

- Avoidance of penalties and fines: Inaccurate or incomplete documentation can result in penalties, fines, or even legal issues. By ensuring proper documentation, businesses can avoid costly mistakes and maintain compliance with customs regulations.

Proper documentation, including accurate and complete commercial invoices, is a fundamental aspect of international trade. It ensures compliance, transparency, and efficiency in customs clearance processes.

Recent Comments