As an IOR and EOR Company engaged in importing or exporting IT and Tech products, it is crucial to understand the concept of customs declaration. It refers to the process of providing the necessary information and documentation to the customs authorities when crossing international borders. It serves as a means to regulate the flow of goods, enforce trade regulations, and ensure proper collection of duties and taxes.

Why is customs declaration important?

It plays a vital role in international trade for several reasons.

- Firstly, it helps customs authorities in monitoring and controlling the flow of goods across borders. By declaring the contents of your luggage or shipment, customs officials can identify any prohibited or restricted items, such as firearms or drugs, and take appropriate actions to ensure the safety and security of the country.

- Secondly, it enables the collection of import duties, taxes, and fees. These funds contribute to the country’s revenue and support various public services and infrastructure development.

- Lastly, it helps in enforcing trade regulations and preventing illegal activities, such as smuggling or money laundering, by providing transparency and accountability in international trade transactions.

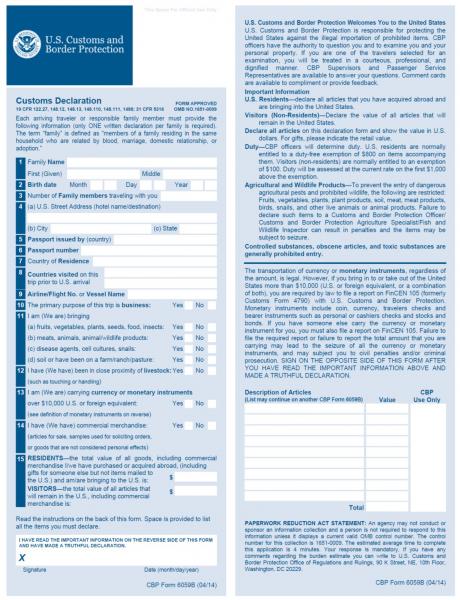

Understanding the customs declaration form

The form is a document that contains all the necessary information about the goods you are carrying or shipping. It is essential to fill out this form accurately and completely to avoid any delays or penalties. The form typically requires you to provide details such as your personal information, the description of the goods, their quantity and value, and any applicable supporting documents.

Step-by-step guide to declaring customs

Declaring customs may seem like a daunting task, but with the right knowledge and preparation, it can be a straightforward process.

Here is a step-by-step guide to help you through:

- Understand the regulations: Before you embark on your journey or ship your goods, familiarize yourself with the customs regulations of the destination country. Each country may have specific requirements and restrictions that you need to comply with.

- Prepare the necessary documents: Gather all the required documents, such as your passport, visa, purchase invoices, and any permits or licenses related to the goods you are carrying or shipping. Make sure to keep these documents organized and easily accessible.

- Complete the form: Fill out the form accurately and honestly. Provide detailed descriptions of the goods, including their quantity, value, and purpose. If you are unsure about any information, seek assistance from the customs officials or consult a customs broker.

- Declare any restricted or prohibited items: If you are carrying or shipping any restricted or prohibited items, make sure to declare them on the form. Failure to do so can result in severe penalties or confiscation of the goods.

- Submit the form: Submit the completed form to the customs authorities. If you are traveling, hand it over to the customs officer at the border. If you are shipping goods, submit the electronic online.

- Cooperate with customs officials: During the customs clearance process, be prepared for inspections or additional inquiries from the customs officials. Cooperate with them and provide any requested information or documentation promptly and honestly.

- Pay applicable duties and taxes: If there are any import duties, taxes, or fees applicable to your goods, pay them as per the customs regulations. This can usually be done at the customs office or through an online payment system.

Exceptions to Customs Declaration Requirements

While it is generally required for all international travel and shipments, there are some exceptions to consider. In certain circumstances, you may be exempt from declaring customs.

For example, personal effects or gifts below a certain value may be exempted from declaration. However, it is crucial to check the specific regulations of the destination country to ensure compliance. Additionally, some goods may require specific permits or licenses, even if they fall within the exemption limits. It is always advisable to research and seek professional advice if you are unsure about the requirements.

What is a Commercial Invoice?

A commercial invoice is an important document in international trade, closely related to customs declaration. It serves as proof of the transaction between the buyer and the seller, detailing the goods, their value, and the terms of sale.

The commercial invoice is used by customs authorities to assess the import duties and taxes applicable to the goods. It is essential to ensure that the information on the commercial invoice matches the details provided in the customs declaration form to avoid any discrepancies or delays in customs clearance.

What are customs fees?

Customs fees, also known as customs duties, are charges imposed on imported goods by the customs authorities. These fees are calculated based on the value of the goods and their classification in the customs tariff.

The purpose of customs fees is to protect domestic industries, regulate trade, and generate revenue for the country. The rates of customs fees vary from country to country and depend on factors such as the nature of the goods and the trade agreements in place. It is important to consider these fees when calculating the total cost of importing goods to avoid any unexpected financial burdens.

Should I select DDU, DDP, or FCA?

When shipping goods internationally, you may come across terms such as DDU (Delivered Duty Unpaid), DDP (Delivered Duty Paid), or FCA (Free Carrier). These terms define the responsibilities and obligations of the buyer and the seller regarding the customs clearance and transportation of the goods.

DDU means that the buyer is responsible for the customs duties and taxes upon arrival, while DDP means that the seller takes care of these charges. FCA, on the other hand, means that the seller delivers the goods to the carrier nominated by the buyer, and the buyer assumes the responsibility from that point onwards. The choice between these terms depends on various factors such as the nature of the transaction, the relationship between the buyer and the seller, and the level of control and risk each party is willing to assume.

Shipping to the European Union

If you are shipping goods to the European Union (EU), it is essential to understand the customs procedures and regulations specific to this region. The EU has a common customs area, which means that goods can move freely within its member states without customs duties or border controls. However, when importing goods from outside the EU, customs declaration is still required.

It is important to comply with the EU’s customs regulations, including providing accurate and complete customs documentation, following any specific requirements for certain goods, and paying any applicable customs fees.

Conclusion

It is a crucial aspect of international travel and trade. It ensures the smooth flow of goods across borders, supports the collection of import duties and taxes, and helps enforce trade regulations. Understanding the form, following the step-by-step guide, and being aware of the exceptions and related terms will enable you to navigate the customs clearance process effectively.

Remember to always stay informed about the customs regulations of the destination country and seek professional advice if needed. By being diligent and compliant with the customs requirements, you can ensure a hassle-free experience and contribute to the integrity and security of international trade.

Recent Comments